Dear Readers, this week, I wanted to share a bit about Options trading. Options are something I have used extensively to both help lower volatility as well as create specific trading strategies that help me boost overall returns. While they initially appear complicated, the core concepts are actually fairly simple once you understand them. Admittedly, mastering Options trading is considerably more difficult and there is considerably more complex mathematics behind it but I think there is definitely a place for them in every investor’s toolkit.

For those that are paying subscribers, I share my real time trades including Option trades in my subscriber chat. For those that are interested in following along or if after reading this post, you find yourself interested in learning more about Options, consider furthering your support by becoming a paid subscriber and join us in the chat to continue learning.

Alright, let’s dive right in!

The Basics

Let’s start with what exactly is an Option. Fundamentally, an Option is a contract that grants the owner the rights to buy or sell something at a specific price within a set amount of time. That’s where the term “Option” comes from. By owning the contract, you have the option to do something although you’re not required to do it.

Now there are 2 specific types of options, Calls and Puts. Let’s talk about each of these in turn.

Call Options

A Call option gives you the rights to buy a stock at a pre-specified price, also known as the strike price. Specifically, 1 call option will allow you to buy 100 shares of a stock. For example, if you owned an AMZN call option at $200, it will let you buy 100 shares of AMZN stock at $200/share as long as your option has not expired. If AMZN stock rises in price above $200, you can then immediately sell it and net the difference. On the other hand, if the price of AMZN is below $200, you don’t have to buy the shares and you can just let your options eventually expire worthless.

Here, it’s good to start introducing the shorthand notation we will use to refer to options as well. The call option we described might be more concisely written as “AMZN 05/02/2025 200 C”. The notation here includes the name of the stock, the expiration date, the strike price of the call, and finally the “C” to denote that it is a Call option in shorthand form. Specifically, this means for each contract you own of this, you have the rights to purchase 100 shares of AMZN at $200/share at or before May 2nd, 2025.

Once you understand the concept of an option contract, it’s just an investment vehicle like a stock. The contract itself also has a market price. For example, you might be able to buy the AMZN 05/02/2025 200 C contract for $8. We call this the premium. Now remember when I said 1 option contract lets you buy 100 shares? This is a common point of confusion among those first starting out in options but the cost of the contract is actually $800, that is, it’s the quoted price multiplied by 100 shares.

Now let’s put all this together in a simple example. Suppose the price of Amazon stock today is $195/share. When you check Call options, you see AMZN 05/02/2025 200 C priced at $8 so you pay $800 to buy 1 call option. Now fast forward to the end of April and Amazon stock has risen to a market price of $220/share. You can now exercise the option which is just a fancier way to say “use the contract” to buy 100 shares of AMZN at $200/share. You can then turn it around and immediately sell those shares for the market price of $220/share to earn $20 per share of $2000 total. But wait, recall that you initially paid a premium of $800 for the option contract. Your net earnings in this scenario would actually be $2000 - $800 = $1200. Fairly straightforward right?

Put Options

A Put option is the reverse of a Call option. It gives you the rights to sell a stock at a pre-specified price. For example, if you own an AMZN put option at $190, it will let you sell 100 shares of AMZN at $190/share as long as your options has not expired. This means even if the stock drops by a large amount, you are protected for the duration you own this Put option and can sell the stock for $190/share.

The shorthand notation is consistent with what we described in the Call option section above. A put option can be written as “AMZN 05/02/2025 190 P”. This contract gives the owner the right to sell 100 shares of AMZN at $190/share at or before May 2nd, 2025.

Now let’s review a simple example of a Put option. Similar to the previous scenario, suppose the price of Amazon stock is $195/share. When you check Put options, you see AMZN 05/02/2025 190 P priced at $6 so you can pay $600 to buy 1 put option. Assuming at the end of April, Amazon stock has dropped to market price of $180/share. You can buy 100 shares of Amazon at the market price of $180/share then turn around and immediately exercise your option to sell 100 shares of AMZN at $190/share. Your net earnings in this scenario would be the $1000 you made from selling the difference minus the $600 you paid for the option thus you would earn $400 in this example.

Although the examples above involve exercising the options, this is put there to make understanding the concepts easier. In practice, you are far better off selling the option itself for an increased premium. As we will see in the following section, this is because options also have value due to their time until expiration. By exercising an option, you are cutting that value short.

It’s also important to remember that the examples above used buying options to initiate the trade. You can just as easily sell an option to give others these rights and collect the premium from those sales. We cover this in more detail in the strategies section of this post at the end.

Valuation of Option Premiums

Now that we reviewed the basics of what is an option, it’s time to discuss a bit more about valuing an option. As you can see in the examples above, the contract itself has value which we call the premium. In our Call option example, they were worth $8 and in the Put option example, they were worth $6.

Intuitively, there should be three main things that drive premium valuation.

Time Value - The longer an option contract is before expiration the more valuable it should be. This makes intuitive sense since you have more time to exercise your option. Commonly, options expire every third Friday of the month. Nowadays, many of the more popular stocks will also have weekly options in the short term that expire every Friday in the near term to allow more flexible positioning in the short term.

Moneyness - This term refers to the difference between the strike price of the option and the market price of the stock. Using the Amazon Call example above where the market price of AMZN was $195, a call option with a strike price at $200, AMZN 05/02/2025 200 C, would be less valuable than a call option with a strike price at $190, AMZN 05/02/2025 190 C. Using more formal terminology, we would say the $190 call is “in the money” while the $200 call is “out of the money”. Specifically, the $190 call has inherent value because I can execute the option immediately to earn $5 per share. Therefore, the value of these options will definitely be greater than $5.

Volatility - The more volatile a stock is, the greater the premium paid for the option. Intuitively, the bigger the price swing of the underlying stock, the greater the chances that an option would pay out thus why it can command a higher premium. There is a mathematical model to calculate implied volatility (IV) based on the Black-Scholes model but for the purposes of this post, it’s more important to understand the conceptual idea of volatility. Higher volatility = higher premiums.

Notably, these are not the only drivers for premium valuation but they are the key ones. Some more minor details such as dividend payout schedule can also impact option pricing but understanding these 3 main drivers should be sufficient to begin understanding how to determine the value of options.

It’s all Greek to me!

Now that we understand how to intuitively value an option, it’s worth taking the time to formalize the framework. There are some mathematically derived parameters that help characterize the risk associated with an option. These are called the 4 primary Greeks of options: Delta, Vega, Gamma, and Theta.

When you look at an options bid, these Greeks will be listed besides the premium to help you make a better decision so it’s important to at least have a cursory understanding of what they mean. Let’s look at these each in turn.

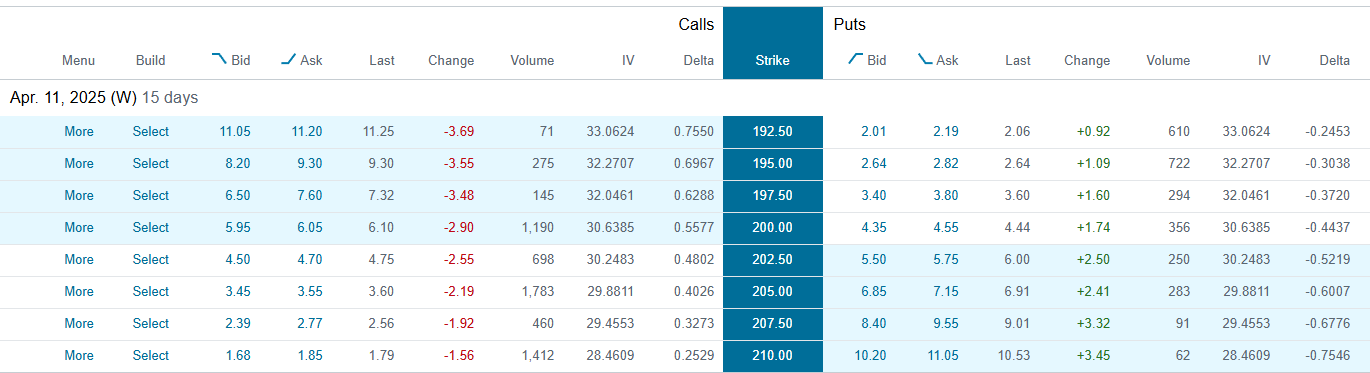

Delta - Delta represents the amount of change in premium price that’s expected for each dollar change in the underlying market stock price. Looking at the $210 strike price option, this implies that if the market price of AMZN increases by $1, the premium for the option should correspondingly go up by 38.4 cents. Importantly, this relationship isn’t linear. The closer the strike price of the option is to the market stock price, the bigger the movement. Notice the $205 strike price in the above picture increases by 47.2 cents for each dollar increase. Now this concept is nice to know but in terms of valuing the underlying premium, I don’t find it directly useful. However, Delta has another implied meaning which I find very useful. It roughly approximates the assumed probability that your option will end up “in the money”. That means if we look at the $210 strike price option, there’s roughly a 38.4% chance by May 2nd that Amazon stock would go above $210 in market value. This gives you an approximate idea of the risk you are undertaking to buy this option. Very very useful!

Gamma - Gamma represents how stable the Delta parameter is. Since Delta doesn’t stay constant, Gamma measures the change in Delta for each dollar change in the underlying market price. Looking at the $210 strike price option, this implies that if the market price of AMZN increases by $1, the Delta parameter would increase by 0.0171 from 38.4 cents to 40.1 cents. Gamma gives a good idea of how stable the Delta parameter and how much weight you should put on the Delta value.

Theta - Theta is my personal favorite of the 4 Greeks and is a measure of time decay. This represents the Time Value of options that gets slowly lost. Specifically, Theta represents the amount option premiums decrease for each day that passes. Using the $210 strike price option above as an example, the premium of $5.60 would be expected to decrease by $0.1245 tomorrow even if all other conditions stay the same simply from the option being one day closer to expiration. In other words, each day of holding 1 contract here costs me approximately $12.45. I use Theta to regularly monitor how much time costs for these options. This can also be especially valuable when using options as an income tool which I discuss in the Strategy section to follow.

Vega - Vega is a measure of how much option premiums change as a function of implied volatility. The specific numbers here relies on the IV term which itself is calculated using an options pricing model. Conceptually though, for each point increase in IV, the premium cost for the option also increases by the Vega amount. Theoretically, it’s possible to create Vega neutral trades that offset implied volatility. Personally though, I have not found this metric to be as useful for retail investors who usually are less focused on hedging positions.

In summary, the 4 primary Greeks are just more rigorous and quantitative representations of the 3 intuitive concepts of Option premiums we covered in the previous section. Broadly speaking, Delta and Gamma cover Moneyness, Theta covers Time Value, and Vega covers Volatility.

Options Strategies

In this final section, I cover some Option strategies I find particularly valuable from my personal experience. For paid subscribers to my newsletter, be aware that you also have real time access to my option trades through the subscriber chat.

The Cash Covered Put

I utilize this simple strategy to make purchases of stock that I am already interested in buying but which is currently at a market price higher than my desired purchase price. Using cash I have on hand, I sell a Put contract at the desired purchase price or lower. For example, if I wanted to purchase AMZN stock at $192.50 instead of the current market price of $200, I could sell a AMZN 04/11/2025 192.50 P for $2.06. This would immediately earn me $206. Then, on 4/11/2025, 1 of 2 things will happen. Either 1) the price of AMZN has dropped below $192.50 at which point, I would have purchased the stock at my desired price and earned $206 premium or 2) the price of AMZN exceeds $192.50 in which case I would have pocketed the $206 premium. I can then repeat this again collecting option premiums while I wait for the stock to hit my desired price.

The Covered Call Income Strategy

Recall in my Primer on Dividend Stocks post, I shared one reason to own dividend stocks is to generate a regular source of income. But what about stocks that don’t pay a dividend?

Don’t despair, using Options, you can also generate a regular source of income. In fact, Options can be a wonderful way to generate a regular source of income at yields far higher than you would obtain from dividend payouts if you’re willing to take on a slightly higher risk profile.

Using stocks I already own to “cover”, I can sell a covered call that generates regular income. Using the example above, suppose I already own 100 shares of AMZN. I could for instance sell a AMZN 04/11/2025 210 C for $1.79. This would generate $179 of income immediately for an option that expires in just 15 days. This would annualize to around a 24.2% return if done repeatedly over a year which is far higher than the 3-4% dividend yields you would obtain from dividend stocks.

It’s worth pointing out that there is inherently more risk in this strategy. Suppose AMZN stock increases rapidly over a short duration of time, your stocks may get "called” away at $210 even though market price has risen to $220.

So what happens if your stock gets called away? Well, you can still continue your income strategy. At that point, you could use the proceeds from your sale to now sell a Cash Secured Put as we discussed in the previous section to continue generating premium income. Repeating between these two strategies depending on if you own the stock or have the cash together is a combined income strategy known as “The Wheel”.

These two are the safest of option strategies and I believe should be in the toolkit of every retail investor. Now let’s review 2 slightly more advanced strategies.

The Loss Limited Short Strategy

Now suppose you would like to short a stock like TSLA 0.00%↑ or MSTR 0.00%↑ but these are hugely volatile stocks and the risk of having an uncontrolled run up is something you simply can not afford to have happen. Options again provide a great way to play this short while limiting your total loss. You can simply buy a Put option of the stock you’re interested in shorting with a reasonably long expiration date. This gives you the rights to sell this stock at the strike price. Now if the stock drops as you expect, you will make all the money between your Put strike price and the new lower stock price. On the flip side, your losses are limited to the premium you had paid for these Put options since no matter how high the stock jumps, you can simply choose to let your Options expire worthless.

The Straddle Strategy

Saddle strategies revolve around playing the volatility of a stock. Suppose you believe the stock is going to be range bound for a duration of time. In these cases, you could simultaneous sell both a Call and a Put option at the same strike price. If the stock does not move too much from that price, you will net the profit of the premiums. Using the AMZN example above, you could sell a AMZN 4/11/2025 200 C for $4.44 and a AMZN 4/11/2025 200 P for $6.10 for a total premium earnings of $1054. Now if AMZN on 4/11/2025 rises to $205/share, you would lose $500 from your call option while your put option would expire worthless. Overall, you would still net a profit of $1054-$500 = $554. Similarly, if AMZN on 4/11 drops to $195/share, you would also earn $554 as your call option would expire worthless but your put option would cost you $500. This strategy is known as a short straddle. It can also be done in reverse by buying both options and is known as a long straddle.

Overall, these provide a general summary of some relatively basic Option strategies which should be in the toolkit of every investor.

I hope this guide provides at least a starting point for readers to begin trying out Option strategies. To start, I advise trying out the covered call and cash secured put strategies outlined. Don’t be put off by the simplicity of these strategies as complexity does not equal greater returns. For example, the best odds in craps comes from just betting the pass line which is the most basic.

The real challenge of options does not come from complex option strategies but from picking both the right direction and timing. Furthermore, option trades should only be made when the premium sufficiently justifies the risk.

For a sample of trades, here are the last 3 completed options I shared in subscriber chat:

1 THC 3/21/25 $115 P for $1.75 - expired out of the money. earnings $175

4 JD 3/21/2025 $47.50 C for $0.45 - expired out of the money. earnings $180

1 QCOM 3/7/2025 $148 P for $1.85 - expired out of the money. earnings $185

If you’re still unsure, feel free to follow along with my own option trades in my paid subscriber chat.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. It should be noted the author may own positions in the stocks discussed in this blog which could create a conflict of interest. You should always do your own research before making any final decision on investments.