Dear readers, let’s take some time to review Uber’s Q4 2024 earnings. The stock has had quite a ride. Initially dropping after the earnings release then rising back up 8% almost back to where it was. Importantly, trying to chase market sentiment in this case is not a strategy. Let’s look at the updated results of the Q4, 2024 earnings to assess what the current valuation of Uber should be.

As usual, this post will be available to paying subscribers for early release first. Thank you again for your support!

In addition, this post will be available to everyone else starting on 2/9/2025 @ 9:05 AM PST due to the time sensitive nature of earning release results. Be sure to come back and check it out!

Uber was the very first company I wrote about on Substack. At the time, I felt that they were fairly valued but had potential for synergistic growth opportunities over the next few years. I included a link to the original thesis below.

Uber released their Q4 2024 earnings on 2/5/2025 before the market open. After reading the topline results, I was a bit surprised by the initial market reaction as they looked quite good. However, let’s take a closer review to better understand the market reaction and make a determination if anything changes in our investment thesis for Uber.

Top Line Results

Let’s start by reviewing top line results.

Q4 results show that UBER 0.00%↑ grew gross booking by 18% YoY or 21% YoY on a constant currency basis. I prefer to use the constant currency basis growth as the metric since currency fluctuations don’t really give any indication of how the company is inherently doing.

Revenue also grew 18% YoY to $44.2 billion or 21% YoY on a constant currency basis.

Adjusted EBIDTA also grew 44% YoY to $1.8 billion.

Free cash flow, which is the number we care about the most, grew 122% YoY to $1.7 billion from $768 million a year ago.

These numbers look really good against our expectations of 18% CAGR for FCF over the next 5 years. Obviously, current performance isn’t an indicator of future performance but it certainly look like overall growth remains very fast.

But let’s take a closer look.

Management Execution of their Strategy

Uber management is primarily focused on short-term profitable growth, diversification of revenue, and preparing to integrate autonomous vehicle for the long-term.

Profitable growth

In terms of profitable growth, the topline results show the company is doing an amazing job and was already outlined in the previous section.

Diversification of revenue

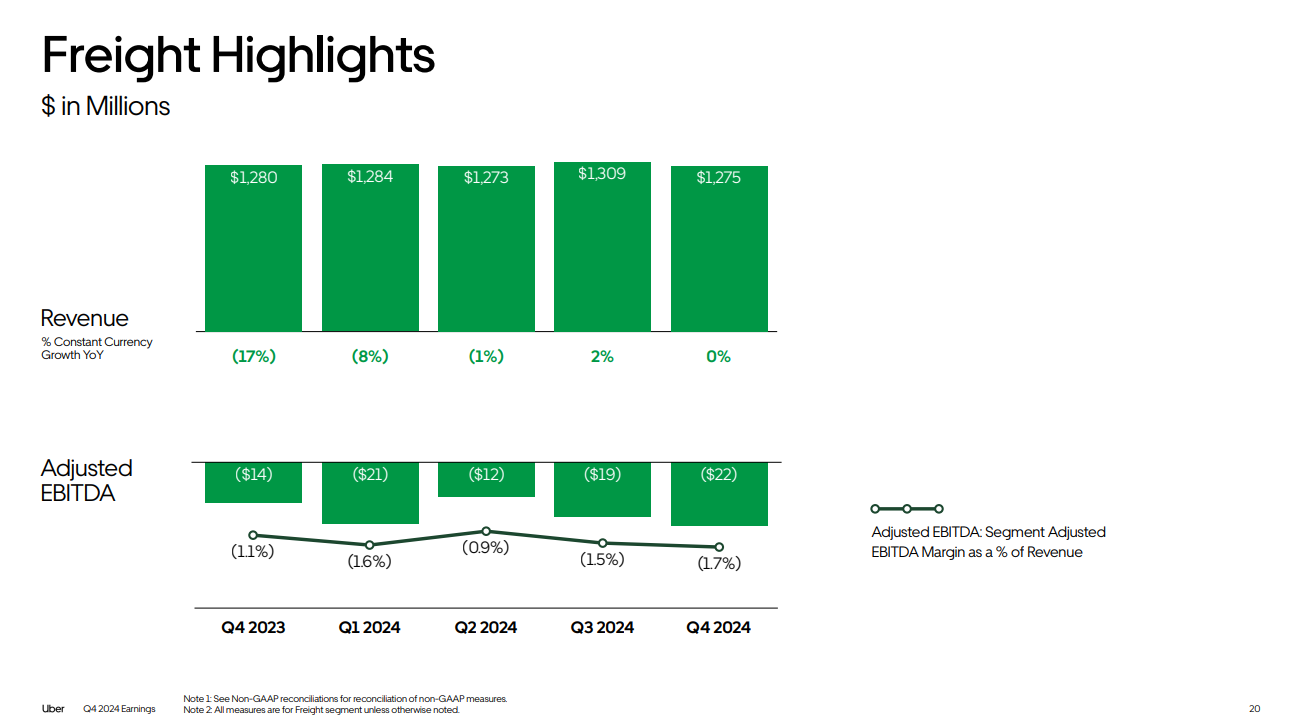

As far as diversification of revenue, both the Mobility (+24% gross bookings YoY) and Delivery (+18% gross bookings YoY) segments are growing at a rapid pace. Freight which has always been the smallest segment has been flat which is ok.

Autonomous Vehicles

For many, autonomous vehicles is the Sword of Damocles for Uber.

For those who don’t know the reference, let’s take a quick sidebar:

The story basically goes that a guy named Damocles envied the king’s power and luxury. So to teach him a lesson, the king offered to trade places for a day. Damocles happily accepts and sits on the throne. Shockingly, he finds that right above his head, there is a sharp sword hanging by just a single strand of hair which could break at any time. Even though Damocles is surrounded by all this wealth and power, he found he couldn’t enjoy it because he was constantly afraid that the sword would fall.

Now back to Uber.

To Uber, autonomous driving could either make them hugely successful or render them obsolete.

On the one hand, self-driving technology could result in massive savings, eliminate human drivers, and possibly even lead to explosive growth as car ownership is no longer a necessity. On the other hand, it opens up Uber’s current business model to new competitors like Tesla and Waymo. If managed poorly, they could quickly get pushed out of the industry they themselves pioneered.

Just like Damocles on the throne, we find Uber’s future has huge opportunity but at the same time, it’s constantly overshadowed by this existential threat. And we know how much the market hates uncertainty.

But let’s take this analogy one step further and think outside the box.

Why doesn’t Damocles just move out of the way? After all, it’s not like he needs to sit on the throne to enjoy the powers that come with being a king right?

Well, that’s exactly what Uber’s management is doing!

Instead of trying to beat out all the competitors, Uber is leveraging their network and co-operating with these competitors creating a new business model. This way, they provide the profitable software layer but not the costly capital structure for owning AVs. Only time will tell if this works but at least it sounds very reasonable to me.

In terms of their execution, management shared where they are currently partnered. Given the advancements so far, this seems like a strong position to be in today.

One quick complaint about Uber

We’ve seen that topline results look great and management execution of their strategy remains sound. However, there’s one complaint I do have which we should discuss briefly for completeness. And it’s not the miss in operating income which you may have seen pop up in some recent Uber articles. I believe that is a non-issue after closer inspection as this is just money set aside for legal issues.

Instead, it’s related to their stock-based compensation.

If you’re following the recent Uber related news, you may remember that Uber announced an accelerated stock buyback plans early in January for $1.5 billion. This is part of the $7 billion stock buyback the company has approved.

Now if you’ve read some of my other posts, you may remember that I very much approve of stock buybacks and return of value to shareholders. So what’s the issue?

Well, the problem is there is literally no return of value to shareholders in this case. A quick look at the cash flow statement reveals that in 2024 alone, the company gave away almost $1.8 billion in stock-based compensation (SBC). Therefore, the $1.5 billion spent on buyback is not even enough to offset this dilution.

Now this isn’t a dealbreaker and I like the trend that this is decreasing from 2023 as well as quarter by quarter (not shown here). My hope is with Uber’s rapid growth over the next few years, the relative size of this SBC will be considerably smaller and Uber can begin reducing their total outstanding shares.

It could even be argued that this is necessary to be competitive in the labor market. After all, the cost associated with SBC also impacts competitors like Lyft and the impact on those companies is proportionately even greater.

However, I bring it up here in this quarterly review as it should change our view of these stock buybacks. I view them as necessary to keep stock dilution in check rather than a return of value to shareholders. If we look at Uber’s shares outstanding over the last 5 years, we see why this is something to keep an eye on.

As long as Uber remains a high growth company, I think this is acceptable though not desirable.

Valuation of Uber

Let’s re-examine our valuation estimates based on the updated information from Q4, 2024 earnings.

DCF method: Notably from our original investment thesis, we assumed:

FY25 FCF of $6 billion

Year 2-4 growth rate: 18%, Year 5-6 growth rate: 10%, Longterm growth rate: 4%

9% discount rate

Full FY2024 FCF came in at $6.895 billion, considerably higher than our conservative estimates. Based on this, it seems reasonable to assume FY2025 to be $7.7 billion. Given topline results, we believe the growth rate assumptions are slightly conservative but still reasonable so we don’t make any adjustments there. Based on this, our updated assumptions are:

FY2025 FCF of $7.7 billion

Year 2-4 growth rate: 18%, Year 5-6 growth rate: 10%, Longterm growth rate: 4%

9% discount rate

which gives an intrinsic valuation of $109.67.

Traditionally, I have not accounted for stock-based compensation in my DCF valuation as this is typically not considered cash exchanging hands. Over time though, I’ve debated whether this is truly appropriate since the company ultimately needs to spend money on stock buybacks to offset the associated stock dilution just like the section discussed above. For now, I will also include a DCF valuation that includes reducing FCF in the first 6 years by $1.5 billion a year.

This adjustment gives an intrinsic valuation of $97.89.

This is a considerable improvement compared to our previous assessment due to the realized FCF growth.

EPS method: EPS for FY2024 came in at $4.56. However, after removing the $6 billion one time credit this quarter, we approximate EPS for FY2024 at $1.77. Using a desired P/E of 30 and a projected growth rate of 30% suggests an intrinsic valuation of $68.64.

To arrive at a final fair market valuation, we average the 3 estimates equally (for now) to arrive at a valuation of $92.07.

Overall Summary

In summary, our assessment of the earnings results leads us to believe Uber is significantly undervalued. From a valuation perspective, we believe a pricing under $76.73 is a good deal offering 20% margin of safety.

The key to whether this will be a great investment lies in whether the 18% FCF growth over the next few years is achievable. All signs currently point to yes.

That’s it for this quick investment update on Uber.

If this was interesting, consider stopping by the BlackSwan Investor Main Page to see what other topics you may have missed.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. It should be noted the author may own positions in the stocks discussed in this blog which could create a conflict of interest. You should always do your own research before making any final decision on investments.