Investment update on Lantheus #1

New acquisition grants an early entry ticket to the Alzheimer's space

Dear readers, our newsletter has now been active for 2 months and we’ve gone through 8 promising deep dive investment thesis with good value propositions. Thank you for staying with us as we continue to improve on the format of these. If you’ve missed any, you can find them here:

Today, we’re going to introduce a new format “Investment update” which are intended for reviewing important changes or more specific deep dives related to companies we’ve already covered via Investment thesis. The intention here is for these to be shorter more focused posts to react to current news and changes in these companies.

Ok, so let’s talk about Lantheus. This niche biotech was one of the first companies we reviewed over a month ago. If you want a quick refresh, I’ve included the link here: Investment thesis on Lantheus.

The news this week is J.P.Morgan. No, not the financial company itself, but the 43rd Annual JP Morgan Healthcare Conference (hosted by them) that happens every year in early January. This year was a little bit later than most and happened Jan 13-16. Those who don’t follow this industry closely may not be aware of it but it’s the largest investment-focused healthcare conference in the world and a massive number of deals, mergers, acquisitions, partnerships get their start here. Naturally, it’s also the place where many important breakthroughs and announcements are made.

Coming back to Lantheus, they made an important announcement at J.P. Morgan that they intend to acquire Life Molecular Imaging for $350 million in upfront payments plus up to $400 million in milestone payments . Let’s review the implications.

Post is under early release and will be available for free on 1/26/2025.

For my paid subscribers, a big thank you, please read on!

How are they paying for it?

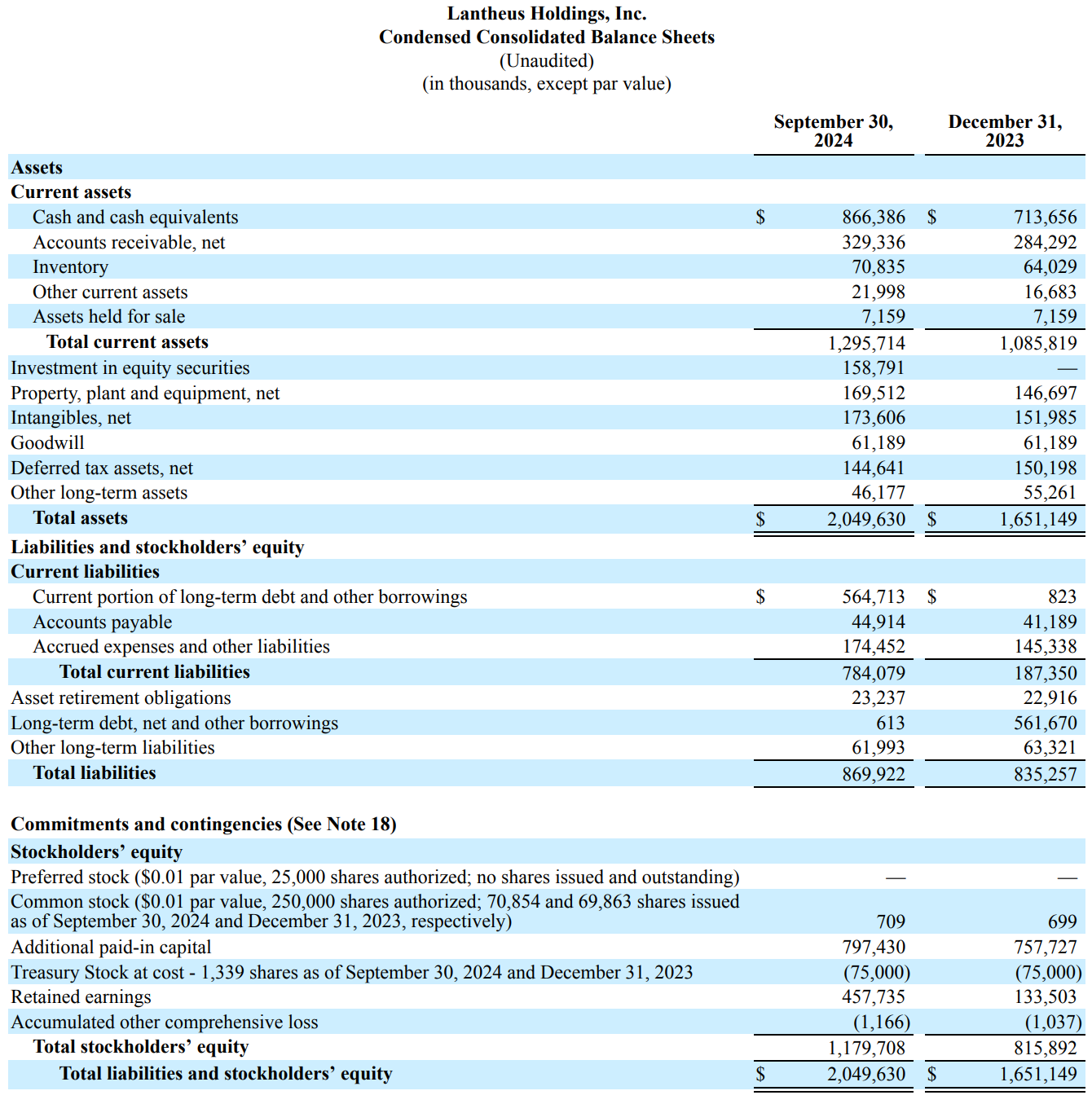

Lantheus as of September 2024 had $866 million dollars in cash and cash equivalents. This is more than sufficient to cover the $350 million upfront payment. During the conference call for this press release, they also confirmed they did not believe this will result in any share dilution which makes sense given their balance sheet.

Lantheus had reported total debt of $621.3 million so even after this $350 million cash payment, with their TTM EBITDA of $548.06 million, their Net Debt to EBITDA ratio sits at a mere 0.19 implying they can pay off all their debts in a little over 2 months of operation. This purchase can be made very comfortably from a financial perspective for them.

What are the benefits of this acquisition?

The biggest and most evident benefit from the acquisition is that Lantheus immediately gets ownership of Life Molecular Imaging’s (LMI) globally approved commercial amyloid beta PET tracer, Neuraceq. Remember in my investment thesis when we talked about future products? At the time, I wrote:

Future prospect of Alzheimer’s: This is a potential to play on the rapidly expanding AD market without taking on the very high risk of high cost phase 3 therapeutic trials.

Well this acquisition would basically bring that future up to now. In terms of rough timelines, management predicts that this would increase speed of entry into the AD PET market for Lantheus by 1 year and into the amyloid beta (Abeta) tracer market specifically by 2 years. Lantheus’s own aTau PET tracer (MK-6240) is probably a year out from market and their Abeta PET tracer (NAV-4694) is probably 2 years out.

It’s worth noting the total amyloid beta PET tracer market in 2024 was approximately $300 million. Neuraceq in 2024 occupies roughly 20% of this market bringing in $60 million in revenue.

The US Alzheimer’s (AD) PET radiodiagnostic market is expected to grow rapidly to $1.5 billion by 2030 and $2.5 billion by 2035. This is because we now have approved Abeta targeting Alzheimer’s drugs whose mechanism of action is specifically to remove Abeta plaques.

For a quick biology lesson on why Abeta and Tau are so important for Alzheimer’s, this intro video from the NIH is a good way to get a quick understanding.

Management also talked about operational efficiency since LMI has an established commercial team and their own R&D team.

On the commercial side, this would mean they now have an established AD commercial presence as well as infrastructure in Europe. Remember that Lantheus traditionally only focused in the US and out-licensed the ex-US market.

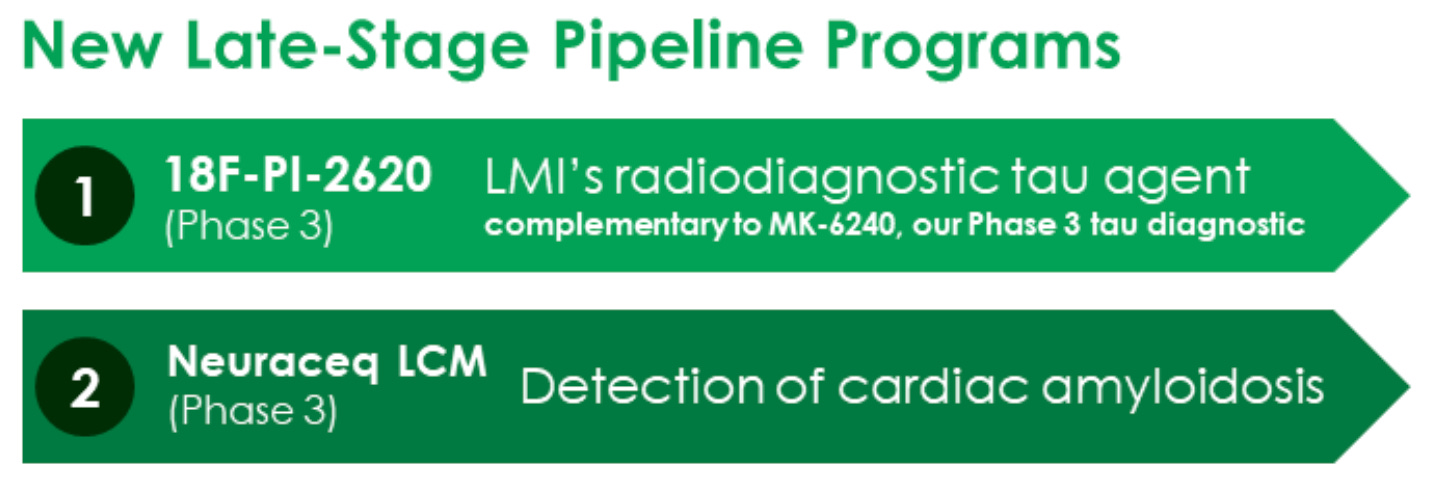

On the R&D late stage development side, this adds 2 products. An aTau PET tracer and an alternative indication for Neuraceq.

It’s worth noting here that with this acquisition, Lantheus now owns 2 aTau PET tracers in late stage development and 2 Abeta PET tracers (1 in late stage development). How these will compete with each other when both are available remains an outstanding question. During the conference call, management addressed this by claiming the 2 tracers have different uses but I don’t believe the examples given are completely satisfactory. Time will tell. For now, I conservatively treat these not as separate products but version upgrades. For example, I treat NAV-4694 as a better version of Neuraceq that may be available in 2 years.

On the early development side, Lantheus had previously acquired the RM2 radiotheranostic program from LMI’s research side in June 2024, which is a diagnostic and therapeutic pair targeting GRPR overexpression in certain cancers like prostate and breast. Whether this would be successful remains to be seen but at least it points to some synergistic benefits here with LMI’s research group.

Valuation update

So let’s take a look at the updated valuation for Lantheus after this acquisition. I first did an assessment based only on the details of the deal using the same assumptions previously used. The changes I made in this case were

I reduced cash on hand by $350 million

increased FCF growth rate in the next 3 years by 1%. Per management guidance, revenue over the next 3 years is expected to increase 2-3% due to Neuraceq but the product has slightly lower margins so I felt this seemed reasonable.

Conservatively assume the future benefits discussed in the previous section do not happen such as improving operational efficiency or benefiting from LMI’s late stage pipeline. Similarly, I assume the $400 million milestone payments also do not happen since none of the benefits were recognized.

Under these assumptions, the acquisition actually was net neutral and led to almost no changes in intrinsic value, $121.17 vs $122.94 previously. This implies the $350 million cash offer could be justified by Neuraceq alone.

Separately, I made some additional updates to my original DCF assumptions and did a more thorough assessment. Notably, I revised my growth projections in my original investment thesis. I believe the growth expectations were too optimistic in the next couple of years as there seems to be consensus that growth from previous years should stabilize considerably in the next few years. In addition, I felt the FCF growth rate for years 5 and 6 was too low as I believe the late stage pipeline along with the AD market opportunity should support more opportunity for success. With these changes, I made the following updated assumptions to update the DCF model:

FY2025 FCF of 394 million

9% discount rate

7% FCF growth in 2026, 2027, 2028 followed by 10% FCF Growth in 2029 and 2030.

$400 million reduced from FCF in year 2028 to reflect milestone payment commitments

which suggests an intrinsic value of $122.50. It’s worth noting that although the valuation here happened to not change much, this was coincidental. The underlying growth assumptions were adjusted quite a bit to reflect current beliefs but the 2 changes happened to mostly negate each other.

Combining this with the original EPS based valuation reaches a composite suggested fair market value of $114.78.

Final thoughts on the acquisition

The acquisition based on our assessment seems to be a great one for Lantheus. Not only does it fit the strategy Lantheus was already pursuing, it can be done easily with cash on hand. From a value perspective, the existing commercial product, Neuraceq is already worth the $350 million upfront payment. We can assume the milestone payments of the remaining $400 million would only be given when Lantheus also profits incrementally.

Since the $350 million cash loss is expected to be mostly made up for by the Neuraceq acquisition, I continue to purchase at $95 or lower since that still represents around a 20% upside from fair valuation.

In theory, the rest of the acquisition outside of Neuraceq for $350 million is all upside. I plan to maintain a wait and see approach to see if we unlock the other potential benefits from this acquisition. I’m looking forward to this deal closing in the later half of 2025.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. It should be noted the author may own positions in the stocks discussed in this blog which could create a conflict of interest. You should always do your own research before making any final decision on investments.