Dear readers, as I go through these investment updates, I’ll highlight the key points but there are many nitty gritty details that I will leave out. If you have follow up questions or things to discuss, please visit our chat and feel free to drop a line. Or just stop by to say hello! I’m sure our community of investors will be happy to help!

Also, if you find these posts helpful, as always consider further adding your support as a paying subscriber. A new paid only post will be coming out soon and you won’t want to miss it. Thanks in advance! Alright, let’s talk about Chubbs.

Chubb Limited released their Q4 2024 earnings 1/28/2025 after market close and had their earnings call this morning 1/29/2025. By the way, if you haven’t read the Investment thesis on Chubb Limited, I strongly recommend taking a look to familiarize yourself with the company.

Ok let’s get started and take this opportunity to review key highlights and update our valuation estimates based on all this new information.

L.A. Wildfire Impact

Right off the bat, the elephant in the room was addressed.

L.A. Wildfires are estimated to result in a spend of approximately $1.5 billion pre-tax

Let’s put this in perspective a bit. Chubb previously had reported losses of about $300 million for Hurricane Milton in 2024 and $1 billion for Hurricane Ian in 2022. So the losses here are large but on an order of magnitude that Chubb can certainly successfully manage. Considering the magnitude of the fire, the company must have already significantly reduced their exposure before this happened. Valuation wise, we will account for this upcoming $1.5 billion loss by directly reducing the free cash flow in our update.

As far as the quarter itself, Chubbs reported great quarterly earnings of $6.02 per share which beats the Zacks Consensus Estimate of $5.46 per share. Importantly, all 3 segments performed remarkably well.

P&C segment

This segment is the core business for Chubbs and accounts for ~84% of the net premiums written in 2024.

This segment had a 7.7% growth over last year (Dec to Dec).

Net income for P&C came in at $5.8 billion for the year.

The combined ratio remains strong at 86.6% in aggregate compared to 86.5% last year.

Overall this segment showed steady growth.

Life Insurance segment

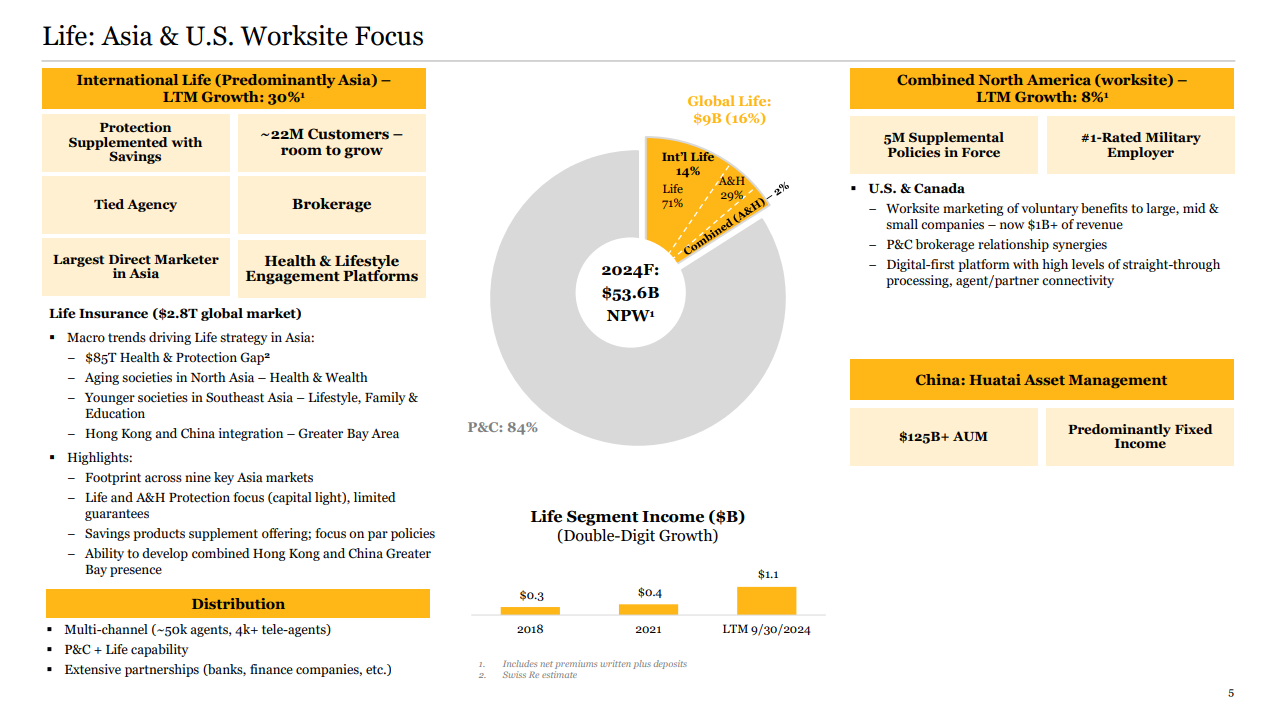

This segment is the life insurance business and represents about 16% of the net premiums written. As we mentioned in our original investment thesis of the company, the Asia segment continues to grow quite fast and remains a growth driver for Chubbs.

This segment had a 15.7% growth over last year (Dec to Dec).

Net income came in at $1.1 billion for the year.

This segment remains the growth driver for Chubbs.

Investment segment

This segment holds the bulk of the money that Chubbs uses to pay out claims which sits in high grade liquid assets. Read more about how ridiculous of a money maker this is in my original investment thesis.

Pre-tax net investment income was $5.93 billion.

This segment’s income increased 20.1% from last year highlighting a shift towards private portfolio with better payoffs. I would expect to see further contribution to income from this shift

Valuations on Chubb Limited

Ok, so now it’s time to update our valuations.

DCF method: We previously assumed operating cash flow for FY2025 to be $12.5 billion. Looking at current numbers, FY2024 operating cash flow was $14.8 billion and adjusted for net investing activities of Huatai’s asset management was still $14.5 billion. Given this, I think our previous DCF assumptions of 4% growth were too conservative. (we knew this was likely the case but wanted to remain conservative until more data came in.) Instead, I think it’s reasonable to assume 7% growth and subtract $200 million for CapEx giving us a FY2025 FCF of $15.3 billion instead.

I further assume:

7% FCF growth in 2026, 6% growth in 2027, 5% in 2028, and 4% thereafter

I directly reduced intrinsic value by 1.5 billion to account for the wildfires.

9% discount rate

suggests an intrinsic value of $747.97/share.

P/E method: CB reported $22.70 EPS for FY2024. Assuming a modest growth rate of 6% (increased from 4%) and an industry PE average of 12 suggests a fair stock price of $288.74.

P/B method: The current book value per share of CB is $159.77 (note this went down 2.1% due to investment losses). Assuming an industry median P/B of 1.5 as fair suggests a fair stock price of $239.66

Overall Valuation: Averaging the 3 methods of valuation suggests a fair market price of $425.46 per share. Note this is an increase from the fair market valuation of $360.77 per share assessed at the end of last year.

As usual, we allot a 20% further margin of safety so I would continue to purchase under $354.55/share. This is still a considerable discount compared to current price.

That’s it for this quick investment update on Chubbs. Stay tuned as this next few weeks will have quite a few earnings reports we are tracking.

If this was interesting, consider stopping by the BlackSwan Investor Chat channel to discuss more about this or other investing topics.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. It should be noted the author may own positions in the stocks discussed in this blog which could create a conflict of interest. You should always do your own research before making any final decision on investments.