I’ve owned shares of VLO since 2014 as part of a dividend strategy but have recently decided to substantially increase my holdings in this company as I believe this company is discounted and provides exposure to the energy sector which is expected to do well under the incoming presidential administration. In addition, unlike integrated oil companies like Exxon or Chevron, Valero is exclusively in the downstream refinery business. I view this as a positive since it limits the impact from crude oil prices which I do not believe will increase dramatically in price within the next year. I plan to continue to build my position in VLO as long as share price is below $135.

An overview of Valero

Valero is the largest independent petroleum refiner with 15 refineries currently across US, Canada, and the UK with combined throughput capacity of ~ 3.2 million barrels per day. It generates revenue from 3 segments: Refining, Renewable Diesel, and Ethanol. Note figures below taken from Valero’s investor presentations.

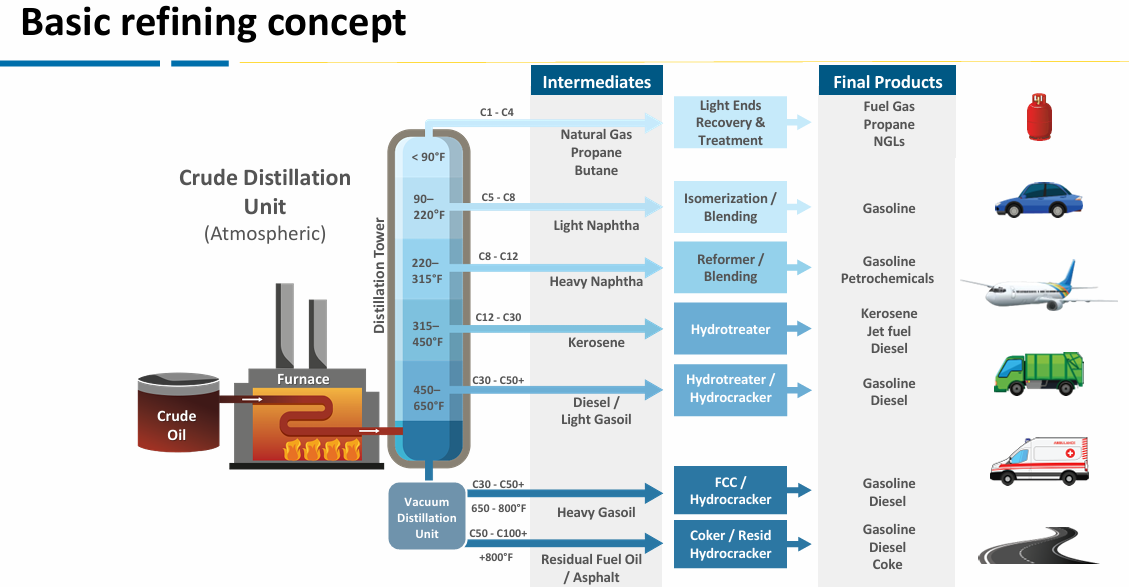

Refining - Refining takes crude oil and converts it to a number of final products for consumption (see figure below). The science and know-how lies in how to mix and match for optimal profit which could be considered a narrow moat for Valero. With 15 petroleum refineries, this segment is by far the largest and is the core business for Valero. In the first 9 months of 2024, Refining accounted for 94.5 billion dollars of revenue, approximately 93% of total revenue. This is also the lowest margin segment (approximately 3.7%) with operating income of 3.5 billion.

Renewable Diesel - Renewable Diesel takes a variety of feedstock including oils and animal fats to produce final products (see figure below). The demand is driven by greenhouse gas emission reduction policy which currently has demand primary in EU & UK with some demand in Canada and the west coast of the US. This segment is both for diversification and to help reduce greenhouse gas emissions and is under the Diamond Green Diesel (DGD) name which is a joint venture between Valero and Darling Ingredients at 50/50. There are currently 2 renewable diesel plants in Norco, Louisiana and Port Arthur, Texas. In the first 9 months of 2024, Renewable Diesel accounted for 3.8 billion dollars of revenue, approximately 3.8% of total revenue. This segment has higher operating margins at approximately 8.8% with operating income of 337 million.

Ethanol - This segment focuses on converting plant-based material like corn to ethanol and provides another source of diversification for Valero. Valero has 12 Ethanol plants all along the US corn belt. In the first 9 months of 2024, Ethanol accounted for 3.4 billion dollars of revenue, approximately 3.2% of total revenue. This is also a relatively higher operating margin segment (approximately 7.9%) with operating income of 268 million.

Valuation of Valero

Valero can generate a ton of cashflow but their business is quite cyclical depending on the inputs (crude oil price) and demand for the refined products. The difference between these is what is referred to as the crack spread which can vary considerably leading to large fluctuations year to year in free cash flow (FCF). Since crack spreads were high in 2022 through early 2024 but have fallen in Q3, 2024, this makes TTM FCF inappropriate to use here for valuation. Instead, assuming the average crack spread is around $18 in the long run, taking 4x Q3 numbers as the annual FCF may be more appropriate.

Using these assumptions, a fairly conservative discounted cash flow analysis (DCF) based on total year free cash flow of 4.34 billion and assuming the following:

9% discount rate

Longterm growth rate: 4%

suggests a fair stock price of $231.71 which is a substantial discount to the market close value of $134.55 on 12/9/2024.

Using an earnings per share (EPS) approach, Valero has an EPS estimate for FY24 of $8.63. Given the crack spread over the year, this seems reasonable as an “average year”. Additionally assuming the following:

EPS growth rate of 5%

PE of 12

suggests an intrinsic value of the stock at $108.74.

To arrive at an estimated fair market value, I weight the 2 estimates with at 2:1 with more emphasis on the DCF estimate since it better accounts for future projected earnings in long term investments. Combining the 2 together, we get a fair market value of $190.72.

Rationale for investment in Valero

Valero is arguably the most efficient refinery in the sector - I believe the refining business has either a very narrow or no moat as can be seen by the number of oil refineries in the business. When there is no moat, operational efficiency becomes critical since the company that can make the product the cheapest and uses their assets most efficiently wins. This may not be evident during periods when things are going well but will become more evident when times become inevitably lean. As shown from Valero’s investor presentation, they are consistently the lowest operating expenses per barrel in the industry. Refinery utilization rates are also consistently above the industry average of 90% for Valero.

Shareholder friendly management with a proven track record - Consistent share buyback. Cash generated is abundantly sufficient to cover both dividends and share buybacks (see payout ratio figure)

There are also some ancillary reasons I am invested such as the discount shown in valuation and the exposure provided to the energy sector allowing some diversification across sectors.

Ultimately, I would purchase Valero at prices under $158/share as this provides a 20% upside at the fair market estimate.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. You should always do your own research before making any final decision on investments.