Investment thesis on Paypal Holdings

Navigating a Strategic Turnaround in a Competitive Landscape

Dear readers, before we get into this investment thesis, I wanted to ask for just a moment of your time. If you’ve been finding these in-depth writeups helpful, I ask that you consider further supporting me by converting to a paid subscription. Your support will help me create more high-quality content and keep this newsletter thriving.

PayPal Holdings is a pioneer in the fintech industry. Established in 1998, PayPal has fundamentally changed the way people handle online transactions. One might argue in this field, they made the biggest advancements since the invention of the credit card.

Over time, the fintech industry grew more mature and increasingly more crowded. PayPal’s company performance also took a hit due to this increased competition and hit a recent low in 2023. In September 2023, PayPal brought on a new CEO, Alex Chriss, who has really turned PayPal into a turnaround story. We believe this tailwind continues to carry into 2025. Let’s examine the company as it stands at the beginning of 2025.

An overview of PayPal Holdings

Paypal’s core business has traditionally been providing a secure digital payment solution. Put simply, they help people or businesses send money to each other and then collect a transaction fee for the service. Simple right?

The transaction revenues comprise of:

Payment processing - fees charged to merchants or consumers for processing transactions

Cross-border transactions - fees charged for sending money to another country which can also include currency conversion.

Peer to peer transactions - fees charged when individuals send money to each other. While standard transfers are free, fees are charged for certain features like using a credit card or cryptocurrency for example. Venmo is the big player here that is a subsidiary of PayPal.

While customers are using the PayPal platform, there is also revenue generated from what PayPal calls value-added services. These include

Interest collected from lending services like Buy Now Pay Later, and PayPal Credit.

Subscription fees such as charging for invoicing

Referral fees which reflect commissions collected for collaborations with PayPal partners

Advertising services - the advertising platform, PayPal Ads, was launched in October 2024 which could be quite interesting but we do not currently have any financial data yet on this venture.

A review of the revenue breakdown shows that as of 2024, approximately 90% of the revenue comes from transaction revenue while about 10% is derived from value added services. Examining past annual reports shows that this percentage of contribution has stayed fairly consistent fluctuating between 8-10% from year to year.

PayPal had a considerable strategic shift after Alex Chriss became CEO in September 2023. Some major changes included:

Introduction of Fastlane to capture users who were previously using guest checkout.

Partnerships with major e-commerce companies like Amazon and Shopify to broaden reach.

Renewed focus on profitable growth over topline growth. In highly competitive industries, operational efficiency is critical so I view this as a major step in the right direction.

Introduction of PayPal Ads to potentially provide a meaningful diversified revenue stream.

These last 2 are particularly important for PayPal.

The renewed focus on profitable growth has helped the company generate considerably more free cash flow. Also, as can be seen in the figures below, operating expenses has been steadily decreasing since 2023. At the same time, top line revenue has continued to grow albeit at a reduced rate of 8-10%. As we will see in the valuation section, this has led to attractive pricing despite the recent run-up in share price.

On the other hand, PayPal Ads is potentially a very exciting new expansion for the business. Since it was only launched in October 2024, it’s difficult to determine how big a role to overall revenue the advertising segment could be. It’s also because of this that I don’t believe the market has adequately priced in the benefits of this advertising venture. There is plenty of reason to be optimistic though when we compare their situation to a company that was in a similar place 2 years ago, Uber.

Leadership: The current head of PayPal Ads is Mark Grether whose previous tenure at Uber was also starting up their advertising division. In 2 years from Oct 2022 to August 2024, he already managed to help Uber’s advertising business achieve $1 billion in annual revenue.

Information: PayPal is in a similar place as Uber was 2 years ago with lots of users and specific information about these user’s habits. PayPal knows “what they buy” while Uber knows “where they go”. I would imagine knowing what they buy is probably a more relevant piece of information for targeted ads.

User base: Furthermore, Uber reported 161 million monthly active users on their platform as of Q3 2024. PayPal reported 432 million active accounts in that same time frame. While it’s not an apples to apples comparison and PayPal does not specifically report monthly active users, we can guesstimate that roughly half of these active accounts are monthly active users (216 million) implying this market is bigger than Uber’s market.

Based on these comparisons of leadership, information, and user base, it stands to reason that PayPal Ads should be a fairly successful endeavor in a short period of time. It’s also worth noting that advertising as a business is a higher margin business than PayPal’s core business and should contribute proportionately more to the bottom line. This will be an interesting metric to keep an eye on going forward as we monitor the impact of the newly released PayPal Ads to determine if it has potential to add substantially to revenue.

To complete the overview of PayPal, I wanted to talk briefly about 2 notable scandals/controversies that PayPal was involved in. I personally don’t believe these meaningfully impact PayPal but it’s still worth discussing in brief.

Misinformation controversy: In October 2022, PayPal proposed a policy to fine users $2500 for sharing misinformation. This change sparked an intense backlash on social media including calls to “Delete PayPal” ultimately leading PayPal to reverse these changes. Despite the backlash, neither revenue or number of active accounts were meaningfully impacted.

Honey controversy: More recently in December 2024, PayPal sparked another controversy associated with their Honey browser extension. Supposedly, Honey was not crediting shopping referrals to the influencer’s affiliate links and instead crediting it to PayPal itself via the Honey extension. Now, when I looked into this, the opinions vary quite a bit from claims of outright fraud to blaming the industry standard of last click attribution where credit is given entirely to the last affiliate link used. Will this impact PayPal meaningfully? My view on this is also no.

First, it seems to be common practice in the industry. Other coupon finders also seem to do this. Secondly, the consumer which makes up the bulk of PayPal’s customer base were not meaningfully impacted. No matter how vocal influencers are, they are the vast minority number wise. And finally, there’s the issue of attention span. For better or worse, the internet has basically shortened our attention spans. The general populace who weren’t directly impacted just doesn’t have enough attention span to focus on these types of controversies long enough to meaningfully impact PayPal’s overall business.

Ultimately, I believe PayPal was just following industry practice here although the fairness of this practice is questionable.

Valuation of PYPL

We look at the valuation of PayPal via discounted cash flow (DCF) and earnings per share (EPS) methods.

DCF method: As of Q3 2024, PayPal management continues to guide a projected FCF of $6 billion which is reasonable given prior quarters reported FCF of $1.76 billion in Q1, $1.37 billion in Q2, and $1.45 billion in Q3.

To determine FCF growth rate, we note total payment volume has been increasing at ~9% YoY in the last quarter while total take rate (the amount PayPal takes from the transaction revenue) has been dropping slightly to 1.86% from 1.91% a year ago. Taking both of these factors into account, we anticipate total revenue should continue to grow at low single digits of ~5-6%.

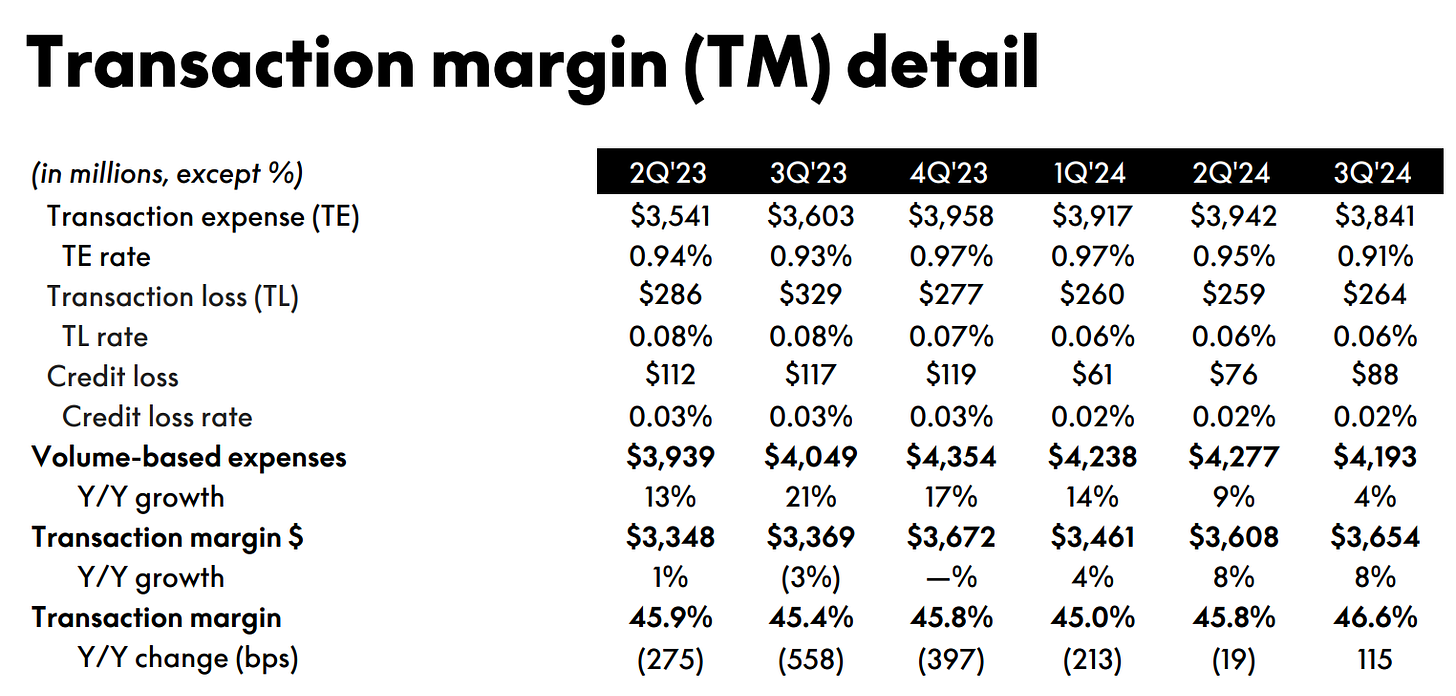

As mentioned in the Overview section, PayPal’s new management has focused on profitable growth which has led to some consistent improvements in operating expenses. This can be seen in the transaction margin improvements as well.

Given a combination of 5-6% revenue growth and improving operating expenses, we believe it’s conservative to assume a 6% FCF growth rate moving forward. I believe 7-8% would also be reasonable but given that we see a pattern of decreasing growth rate in total payment volume, this felt reasonable. Note this number does not include advertising which can potentially also boost FCF.

Thus a very conservative DCF method assumes:

FY25 FCF of $6.36 billion

Continued growth of 6% for the next 5 years

Long term growth rate of 4%

9% discount rate

suggests an intrinsic value of $127.12.

EPS method: Management in Q3, 2024 raised guidance on EPS to approximately $3.92-$3.96 per share. Using the midpoint here of $3.94, a desired P/E of 20 and a projected growth rate of 11% suggests an intrinsic value of $87.47.

To arrive at a final fair market valuation, we weigh the 2 estimates at 2:1 favoring the DCF method as it better accounts for long term investing value and arrive at a valuation of $113.90 which remains a reasonable discount as of this writing.

Rationale for investment in Paypal Holdings

PayPal represents a relatively safe way to get exposure into the fintech sector. There are certainly faster growing companies that are very popular with investment influencers such as Sofi Technologies (SOFI) and Robinhood (HOOD) being 2 that comes to mind. However, SOFI does not meet my stock selection criteria due to negative FCF and HOOD is unfortunately no longer at an attractive valuation after the recent run-up in price.

PayPal currently represents a good risk/reward profile relative to these other fintech stocks at this point. On top of my valuation estimates, PayPal Ads is a nice free bonus that could potentially be a pleasant surprise over the next 2-3 years. And who doesn’t like free stuff?

A quick review of PayPal as an investment based on my Criteria for Evaluating Stocks:

The company should be net income positive - PayPal has been profitable for many years reporting TTM net income of $4.43 billion as of Q3, 2024, $4.25 billion in FY2023, $2.42 billion in FY2022, $4.17 billion in FY2021, and $4.20 billion in FY2020.

The valuation of the company must be attractive -PayPal at this time is considered a fair company at a great valuation. PayPal has been an enduring and well recognized name in fintech. However, until recently, they’ve squandered much of their first mover advantage due to lack of innovation keeping themselves from becoming a great company. At current prices, it represents around a 30% discount compared to the fair market valuation of $113.90 which in itself is a conservative estimate.

Shareholder friendly management - I rate this category as excellent for PayPal. PayPal is a mature company and we do not expect rapid growth. As such, it’s important that management is returning value to shareholders. PayPal does not pay a dividend and management instead chooses to return value back through share buyback. I definitely prefer this route of returning shareholder value and discussed the rationale behind this in A primer to Dividend Stocks. PayPal devotes a substantial portion of their FCF towards stock buyback purchasing $4.2 billion in 2022, $5 billion in 2023, and $6 billion in 2024. For reference, the FCF estimate of FY2024 is only $6 billion implying they’re spending almost all their free cash flow reducing share count while the stock is undervalued. I will note that PayPal spends over $1 billion in stock-based compensation which is a bit of concern but is unfortunately typical of Tech. Overall the total share count has declined from 1.2 billion in 2018 to 1.0 billion in 2024.

Sector diversification and exclusions - PayPal provides exposure to the finance sector which is expected to do well in the current economy under the Trump presidency. The Swan Select Portfolio currently only contains 2 financials: PayPal Holdings and Chubb which provides the desired level of diversification.

Clean balance sheet - PayPal has a good balance sheet with a total debt of $13.26 billion, a cash/cash equivalent of $7.3 billion and a TTM EBITDA of $6.121 billion. This gives a Net Debt to EBITDA ratio of 0.98 implying all debts can be repaid in about a year.

Risks: As always, it’s important to examine the flipside of the argument. One of the reasons I consider a 30% discount on PayPal to be a great valuation is because the risks associated with this stock are lower which makes the risk/reward profile favorable.

Competition leads to erosion of market share - This is the most important risk to be aware of. PayPal faces competition from a number of different competitors. Big tech has started their own payment systems like Apple Pay, Google Pay, and Amazon Pay. On the other side, established credit card companies Visa and Mastercard also compete directly for transactions. Finally younger tech companies like Square and Stripe, the payment processor Substack uses also compete with PayPal. Venmo also has competitors in the P2P business with platforms like Zelle. This is a risk and PayPal did indeed see a loss of active accounts towards the end of 2023. However, as of the most recent quarters (Q2 and Q3, 2024), we see monthly active accounts increasing again by 2% YoY. This gives promise that the turnaround Alex Chriss laid out is indeed happening. We continue to monitor this closely in future quarters.

Margin erosion - As competition increases, there is a risk of prices being driven lower and thus the margins will erode directly hurting profits. I think it is a valid concern and we even see that in the current take rates decreasing over the last few quarters. However, this will happen in any free market and ultimately it comes down to operating efficiency of the company. PayPal has many years of experience, the scale needed to succeed, and a focus on reducing operational expenses since the new CEO came onboard. With this, I think they’re actually better set up than their competitors.

Litigation risk - We briefly discussed the Honey scandal in the Overview section of the post. This may lead to some short term litigation headwind which could result in negative press. As I mentioned in that section, I think it is unlikely and even if it happens, it should only be a short term impact. Longer term, I believe this is a non-issue.

In summary, I believe PayPal is a good investment when weighing risk/reward if purchased under $90 per share as this gives ~ 20% upside potential to the conservative $113.90 fair value. It is one of the stocks in my 2025 Swan Select Portfolio.

Consider stopping by the BlackSwan Investor Chat channel to discuss more about this or other investing topics.

If you enjoyed the content, consider restacking this article to help me get the word out. I also encourage you to take a look at my website BlackSwan Investor for other investing writeups.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. It should be noted the author may own positions in the stocks discussed in this blog which could create a conflict of interest. You should always do your own research before making any final decision on investments.

Good stuff 💡