Dear Readers, our investment in Alibaba has recently seen significant price appreciation this year. While much of this price appreciation was a result of the AI developments, I believe it also provides a nice tailwind for other Chinese stocks that are “Alibaba-adjacent”. Many Chinese stocks are already cheap from a valuation perspective so a market sentiment change like this could be the exact catalyst we’re looking for. I believe JD makes a good candidate here.

As always, if you find this post useful, I would appreciate if you subscribe and if you have already subscribed, consider further supporting my work through a paid subscription which provides access to exclusive posts and detailed reviews of our Portfolio.

Alternatively, consider restacking my posts to show your support and help me get the word out. Thanks in advance!

When we think about e-commerce in China, the 3 major players are Alibaba’s Taobao/Tmall, JD.com, and Pinduoduo. Each of these have a slightly different approach and targets a slightly different demographic but they remain strong competitors to each other. Alibaba’s Taobao/Tmall functions like a marketplace system and is the biggest by gross merchandise volume and serves as a consumer to consumer platform and a merchant to consumer platform respectively. You can read more about that in our Investment thesis on Alibaba.

JD.com on the other hand, focuses more on direct sales and providing a robust logistics network. Customers generally go to them for larger ticket items like electronics and appliances. While this results in additional capital needs to manage inventory, it also comes with much better control over the product sold. For China, where counterfeiting and product quality is often a big concern, I think this offers a unique and significant advantage.

An overview of JD.com

JingDong (JD) in Chinese is written as 京东 which is a combination of the names of the company’s founder Liu Qiangdong and his ex-girlfriend Gong Xiaojing. Since it’s original founding in Beijing in 1998, it’s grown to be China’s largest direct retailer by annual revenue.

JD as a company is a pure retail focused play in China. Despite what the following figure from JD says, they are not a diversified business like Amazon or Alibaba. As you can see from net revenue, the vast bulk comes from retail. This is a different business strategy and comes with pros and cons. As a company, they are even more dependent on the overall economic health of consumers in China. However, they can also keep their strategy and capital deployment far more focused.

JD’s business strategy - Quality Quality Quality!

JD is generally known to cater to the higher end consumer. I believe their focus on quality is a business strategy and key differentiator for them. Probably the best known aspect of the JD brand is it’s strict counterfeit products policy. Any merchant found selling counterfeit products is immediately banned and they also have teams that go out to actively look for counterfeit products. This is probably a nice to have for consumers in the US or EU countries but for a country where product quality has become a major concern, this provides a distinctive competitive advantage.

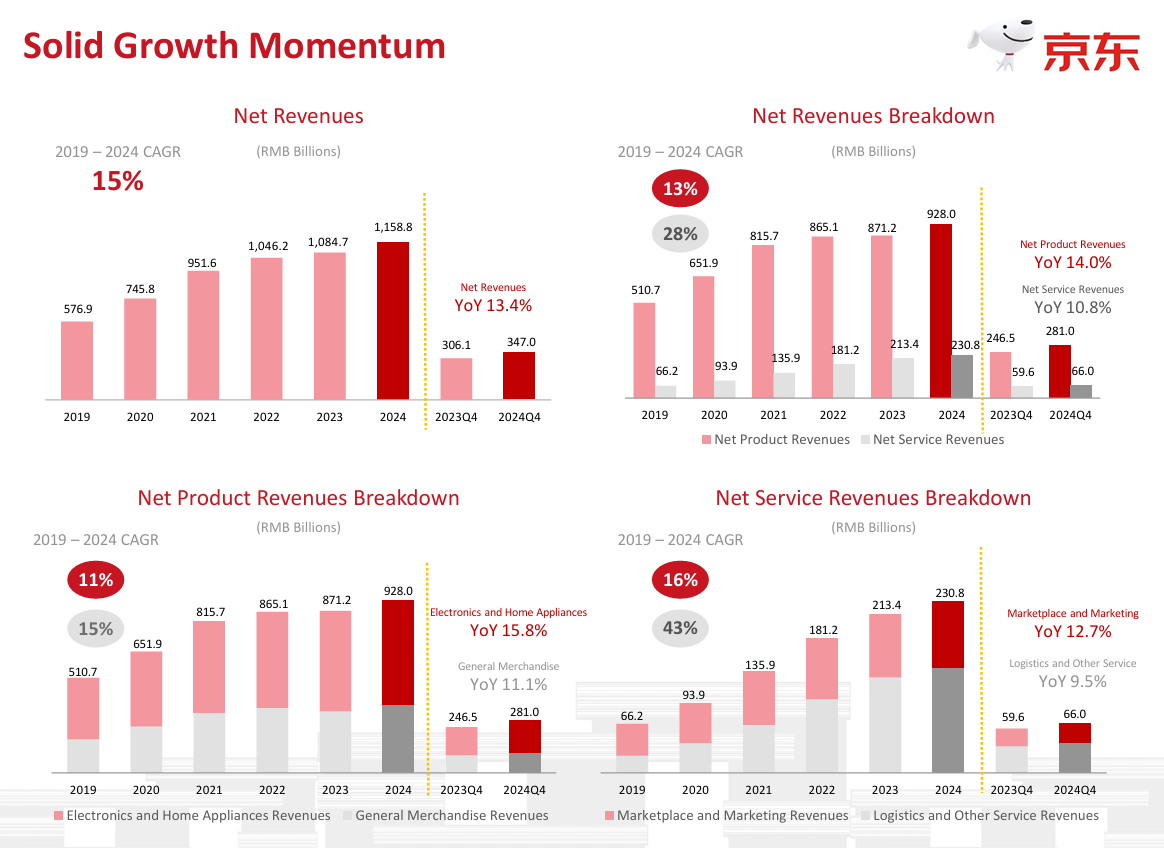

When it comes to running the business, JD has done a remarkable job executing on their business strategy over the years. As we see from their latest Q4 2024 earnings presentation, they’ve grown net revenue consistently even during the economic downturn in China.

I did notice that JD has a tendency to be a bit liberal in how they present their data. For example, although Net Revenue did indeed grow 15% CAGR between 2019-2024, the growth rate is nowhere near that in recent years. In 2022, it was 9.9%, in 2023 is was 3.7% and in 2024 it was 6.8%. Since the Chinese government has been subsidizing appliance purchases towards the later half of 2024, it’s difficult to tell if the 6.8% growth in 2024 is an acceleration of the overall economy or a product of these subsidies. However, the main point here is that they have been able to maintain net revenue growth even during one of the most difficult times.

JD’s future profitability driver - Operational Efficiency

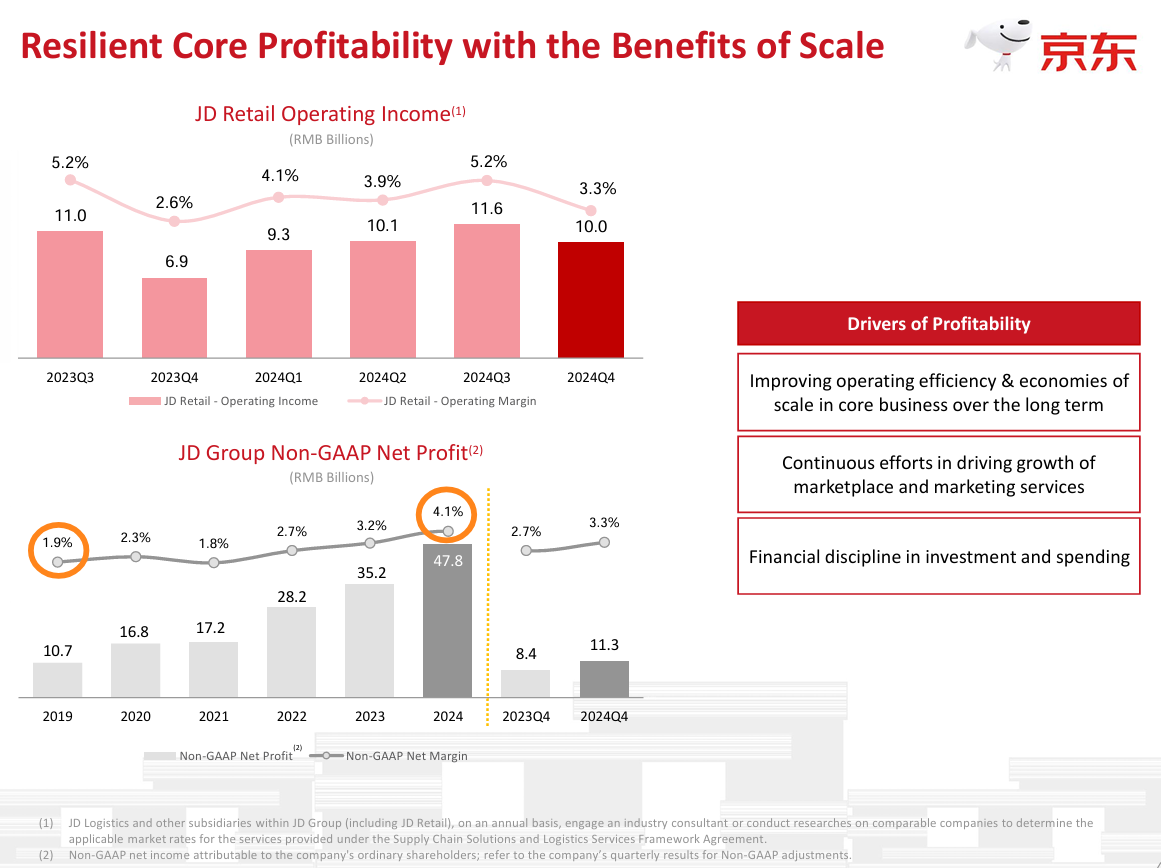

Much like Amazon, JD has been working to improve their operating efficiency. In this area, things do look promising as their non-GAAP net profit has been steady increasing from1.9% in 2019 to around 4.1% in 2024.

Management has highlighted the profit margins as something that they believe will continue to improve. From their latest earnings call, management highlighted:

So in terms of our future profit performance, first of all, for 2025, we will continue to improve our supply chain efficiency in core categories to unlock our potential in profit expansion. At the same time, we will continue to invest in our long-term goals with financial discipline. In terms of our long-term margin target, as we shared before, we believe it will reach a high single-digit level over time. Our steady profit expansion last year made us more confident in achieving this target. - Ian Shan -- Chief Financial Officer

This is actually extremely positive if it is achievable as the already significant cash flow can double without even accounting for further increases in customers. We can look at Amazon for a sense of whether this is achievable since their e-commerce structure is similar with a combination of direct sales and third party marketplace. In our most recent review of Amazon, Investment update on Amazon #1, Amazon reported an 8% operating margin in North America for the quarter. For comparison, JD reported a 4% operating margin in FY2024 so I think there certainly is room to grow.

JD’s new venture - JD Takeaway

Before we wrap up this section, it’s also worth briefly mentioning their new venture into food delivery, JD Takeaway, in February this year. Some analysts have been concerned with JD’s entry into this highly competitive market and whether it would hurt their profitability which already run on thin margins. My personal view of this differs.

I believe this move is extremely synergistic to their existing business model given they already have a strong logistics arm. In addition, it appears management has a clear strategy to focus again on quality emphasizing food safety and high quality food delivery. Time will tell if this is a sufficient differentiator but to me, this is at least consistent with the JD brand approach and seems like a good move strategically.

Valuation of JD.com

Probably the most compelling reason for investing in JD.com is their valuation. We look at the valuation of JD via discounted cash flow (DCF) and earnings per share (EPS) methods.

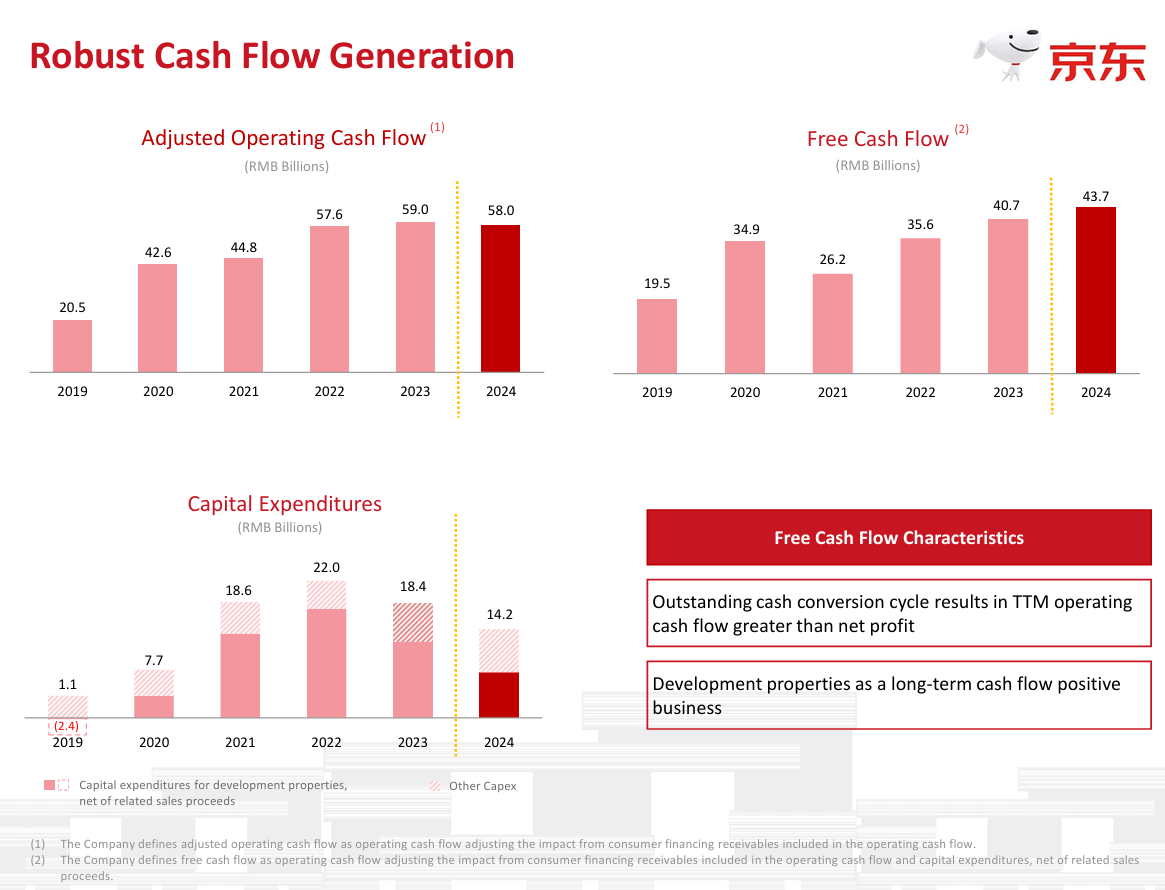

DCF method: JD has consistently generated a robust free cash flow over the years. In FY2024, they reported a FCF of 43.7 billion RMB.

Since we don’t have management guidance on FY2025, we can conservatively assume FCF of $43 billion RMB for FY2025. I left this number slightly lower than 2024 since the capital expenditure for 2024 appears lower than previous years. In addition, we assume:

5% FCF growth rate in FY2026-FY2028 followed by 4% FCF growth long term.

9% discount rate

suggests an intrinsic value of $77.88 per ADS. Further adjusting for an annual SBC of $5 billion RMB adjusts this intrinsic value to $70.54 per ADS.

EPS method: EPS for FY2024 was $3.68 per ADS. Assuming a desired P/E of 15 and a projected growth rate of 15% suggests an intrinsic value of $63.48.

To arrive at a final fair market valuation, we weigh the 2 estimates at 2:1 favoring the DCF method as it better accounts for long term investing value and arrive at a valuation of $68.19. Note, I believe these assumptions are fairly conservative especially given the growth rate is fairly low relative to China’s overall projected economic growth rate.

Rationale for investment in JD.com

Similar to my original rationale for Alibaba, JD.com is a value play. As of the timing of this post, Alibaba itself is no longer a value play due to it’s recent runup in price. JD on the other hand, has not had as large a run-up and still remains a great value proposition. I also believe Alibaba’s recent stock performance can act as a potential catalyst for other well known Chinese stocks that are currently extremely undervalued.

As a business, I believe JD has a good strategy by focusing on Quality which addresses a key concern for Chinese consumers. As a result, I think JD will continue to do well in the Chinese market. We also have some benefit of hindsight by looking at how Amazon has improved operating margins through the utilization of AI. If JD can also implement these changes, the tailwind to their business and future free cash flow through just margin improvements can be substantial.

This investment is heavily reliant on China’s economy as a whole doing well but the upside is far higher than the downside in my opinion. Let’s review JD based on my Criteria for Evaluating Stocks:

The company should be net income positive - JD has been consistently profitable recently except for FY2021 during the height of the COVID-19 pandemic. Net income came in at 41.4 billion RMB in FY2024, 24.2 billion RMB in FY2023, 10.4 billion RMB in FY2022, -3.6 billion RMB in FY2021, and 49.4 billion RMB in FY2020. Given how unlikely another Covid-19-like event is to occur, I consider this an A-.

The valuation of the company must be attractive - I consider JD to be a fair company at a great valuation. While they have a strong business strategy in their e-commerce sector, the company does not have the same expansion opportunities as some of the great companies. Although they’ve been able to show consistent leadership, the retail sector (and the food delivery sector) they are in are also notoriously cutthroat and competitive. I consider this an A- .

Shareholder friendly management - JD offers both a dividend (currently under 2%) and a consistent stock buyback plan that has led to total share reductions. JD currently has a $5 billion USD share repurchase program announced in August 2024. In addition, JD paid out $1.00 per ADS in dividends for their most recent announcement, this amounts to approximately $1.6 billion USD. Since they made around $6 billion USD in FCF in 2024, we can guestimate they are probably returning more than 50% of their FCF annually back to shareholders through a combination of these 2 avenues. If we were to nitpick, one thing I would like to see is a longer history of total share reductions. I consider this an A-.

Sector diversification and exclusions - We currently do not have JD in the Swan Select Portfolio. Addition of this stock would increase exposure to China as well as additional exposure to consumer cyclicals. I believe the additional exposure to China is acceptable with Alibaba + JD but the additional exposure to consumer cyclicals starts to border on too much concentration with Alibaba, Amazon, and JD. I consider this a B if added to the Swan Select Portfolio.

Clean balance sheet - JD has been extremely cautious in their investments and has a very clean balance sheet. They currently have more cash on hand than total debt with 89.8 billion RMB in total debt and 108.4 billion RMB in cash and cash equivalents. I consider this a clear A.

Risks: The risks faced by JD are in many ways similar to risks faced by many Chinese stocks but they are amplified in JD’s case due to their concentration in China. I initially reviewed some of these risks in the Alibaba investment thesis but will outline them here briefly:

The China Risk - I expect tensions between China and the US to only get worse over the next 4 years. Looking forward, the impact of tariffs and economic sanctions are hard to quantify and should be monitored closely. Will current US policy push a friendlier relationship between China and EU? Will China’s economy falter in their recovery due to the added tariffs? These are all questions we will need to continue monitoring.

Heavy competition- Unlike the US where many of these subsectors have clear leaders like Amazon, Netflix, and Uber, China’s competition over market leadership is still quite fierce. PDD for instance only became a serious contender to JD over the last few years. Market share and cost of revenue are things we will need to continue to closely monitor. Notably, if the Chinese economy does better over the next few years, I expect JD to benefit disproportionately with their increased focus on quality over price.

Government subsidy - The risk here is that the Chinese government can not substantially alter Chinese consumer behavior and sentiment. We did observe an uptick in net revenue in the most recent quarter due to Government subsidies on appliance trade ins. However, it’s unclear what percentage of these purchases were “created additional demand” vs “moved-forward demand”. In the later case, consumers would have just bought something they needed to buy sooner due to these subsidies. This would not have created additional demand. If this is the case, we should see a subsequent drop in revenue this year. Changing behavior is particularly challenging. We need to continue monitoring the Chinese government’s policy this year and make a best case assessment.

In summary, I believe JD has a very nice risk/reward profile and there is also the potential for a short term tailwind due to the recent price run-up of Alibaba. Purchases under $48.70 per ADS share would be ideal giving ~ 40% upside potential. I included this additional discount due to the lack of clarity highlighted in risks around consumer behavior. If the next few quarters show continued increase in net revenue, I believe we can increase the justified price higher.

If you enjoyed this content, I encourage you to visit my website, We have a new Table of Contents to help index all our content.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. It should be noted the author may own positions in the stocks discussed in this blog which could create a conflict of interest. You should always do your own research before making any final decision on investments.

I linked to your post in my Monday emerging market links collection post: https://emergingmarketskeptic.substack.com/p/emerging-markets-week-march-17-2025 The NASDAQ listing though means they get alot more attention and volatility compared to Chinese tech-logistics stocks that don't have such listings (e.g. listed in HK etc) and get overlooked...