Amazon is a company that needs no introduction. It’s evolved from an online book store in 1994 to one of the largest and most diversified companies in the world. Unfortunately, I can’t lay claim to having the foresight to invest in Amazon back then. The question here is whether Amazon in 2025 remains a good investment.

AMZN as a stock has gotten a lot of positive press lately given how well the MAG-7 has performed in 2024. Unfortunately, many of these recommendations lack detail and simply state AMZN is a good investment without clarification. Here, we review a more detailed assessment.

An overview of Amazon

The Amazon we know today is a conglomerate with 2 core pillars: e-commerce (both Amazon.com and third-party seller services) and cloud computing (AWS) supported by many other smaller ventures. The smaller ventures are all quite interesting and include:

media and entertainment ventures like Prime Video, Audible and Twitch

consumer electronics including Kindle, Echo, and Ring

advertising through the Amazon platform

physical retail ventures like Whole Foods

healthcare ventures including Amazon Pharmacy and Clinic

AI ventures including Amazon Nova and collaboration with Anthropic AI

space and satellite ventures with Project Kuiper

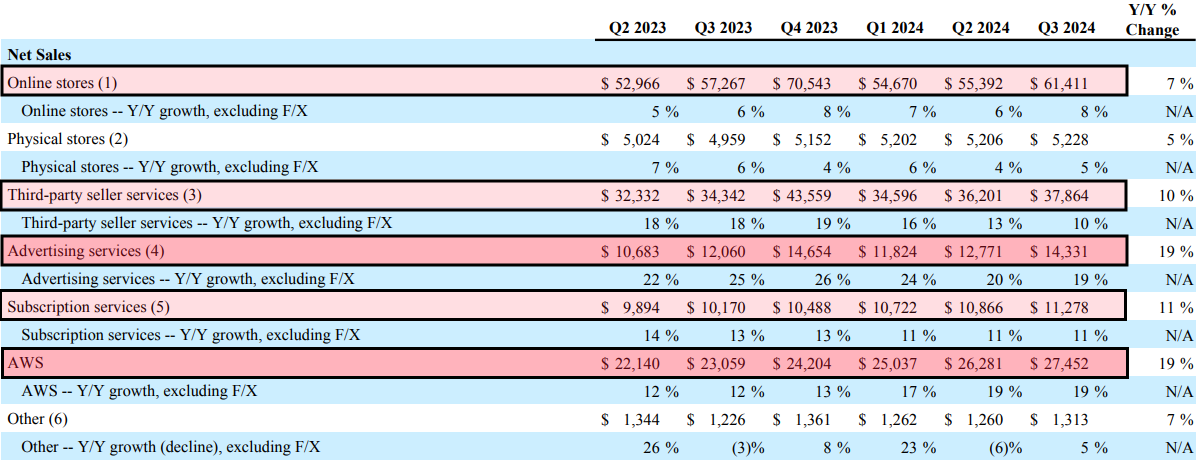

Although Amazon as a conglomerate is quite complex, we can dramatically simplify the assessment by reviewing the breakdown of net sales available in the latest quarterly report (Q3 2024).

Here we see that online stores and third-party seller services account for approximately 62.5% of total net sales. Cloud services through AWS accounts for 17.3% of total net sales. Advertising and subscription services also make somewhat of an impact with 9% and 7.1% of total net sales respectively. All the other ventures do not currently make a substantial enough impact to meaningfully impact the bottom line. The most exciting segments out of these are the AWS cloud computing and advertising services. Both of these are growing at a rapid pace of 19% YoY and also happen to be high margin portions of the business.

So in reviewing the latest earnings report, what are some key takeaways regarding Amazon?

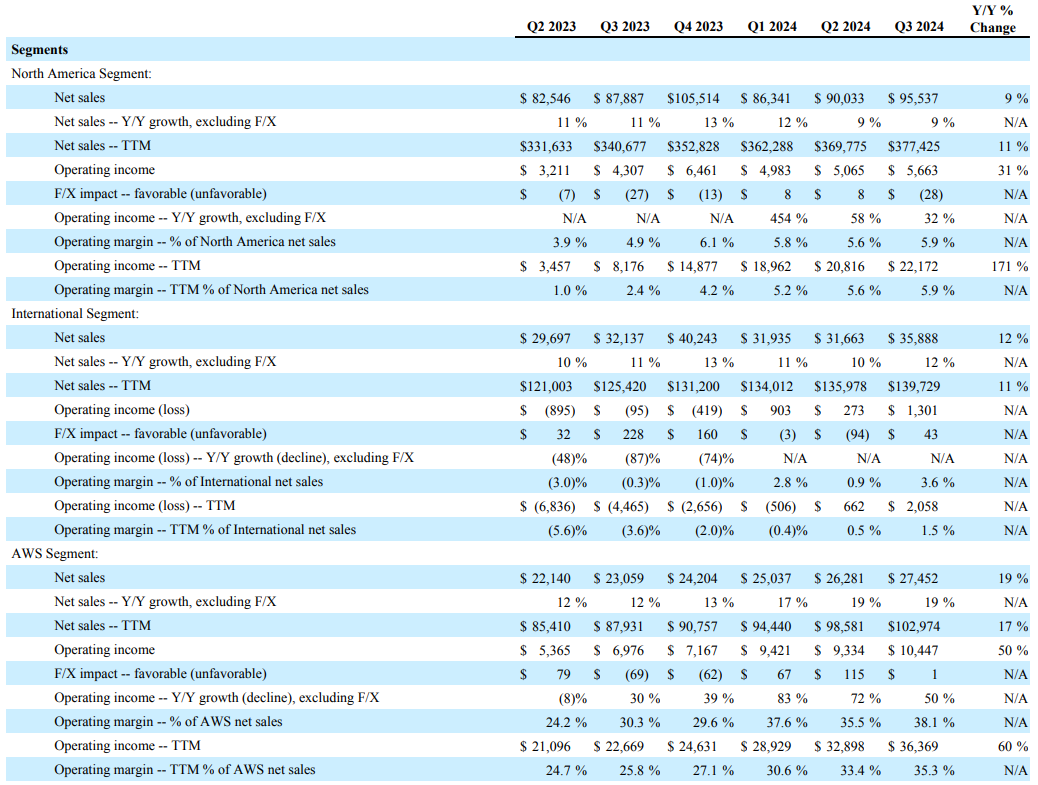

AWS is Amazon’s most valuable segment and growth is accelerating: Amazon breaks down their operating segments as North America, International, and AWS. This allows us to better understand why AWS is often considered the most valuable segment of Amazon. The AWS segment has an impressive operating margin of 38.1% as of the most recent quarter. Compare this to the North America Segment including the e-commerce business which has an operating margin of 5.9%. Notably, this segment even includes the high margin advertising services we discussed earlier. Accounting for the difference in operating margins, AWS shockingly brought in more operating income in Q3 2024 at $10.4 billion than all the other ventures of Amazon including their massive e-commerce business put together ($5.7 billion from North America and $1.3 billion from International)!

E-commerce operating margins are improving: The e-commerce business is typically very low margin and requires scale. This also brings us to the second promising aspect of Amazon. Both the North America and International segments which include their e-commerce businesses are seeing improving operating margins. In particular, we can see TTM operating margins in North America has improved from 2.4% in Q3 2023 to 5.9% in Q3 2024. I believe this is in part to the implementation of the AI aspects into their platform such as Rufus, Amazon Connect (AI customer service), AI applied to their logistics, and in part due to the introduction of higher margin opportunities like advertising. The reason this is so promising is that e-commerce remains the largest percentage of net sales for the company. Because of this, any small increase in margins leads to a substantial benefit in operating income. Operating income in North America for example, went up 32% year over year in Q3, 2024.

International segment is a turnaround story: The international segment has been improving operating margins every quarter and has now shown 2 consecutive quarters of positive operating margins. The operating margins are still very thin here at 1.5% for the current quarter but using North America as a metric for a mature market at 5.9%, we believe reaching 3.5% in 2025 is reasonable with room to improve further in the future.

In summary, Amazon is an incredibly complex conglomerate to understand thoroughly. However, there are 3 key aspects that I believe defines Amazon’s story today.

Impressive cloud computing segment (AWS) with high net sales growth in a segment with high operating margins. This is the most valuable segment of Amazon currently and generates more operating income than all the rest of the company combined.

The e-commerce business continues to grow at a good pace around 10% annually and stands to benefit substantially from the introduction of AI. At the scale that Amazon operates here, even small improvements can lead to considerable profit gains.

The international segment may begin to contribute meaningfully to the bottom line starting in 2025.

Valuation of AMZN

I think it’s fair to acknowledge Amazon is a great company with continued growth potential and stands to benefit substantially from the AI era. The biggest challenge in valuing this company is in trying to predict the free cash flow as the company evolves with improving margins.

To begin, we first estimate the operating income for 2025. Since we don’t have data for Q4 2024, we can use the TTM data from Q3 2024. Operating income by segment for the TTM are: $22.172 billion for North America, $2.058 billion for International, and $36.369 billion for AWS. For the North America segment, we expect 9% top line net sales growth and a further 10% increase due to margin expansion from 5.9% currently to 6.5%. For the International segment, we expect 12% top line net sales growth and a further 150% increase due to margin expansion from 1.5% to 3.75%. For the AWS segment, we expect a 21% top line net sales growth and maintenance of the current 38.1% operating margin. This is higher than the current 19% growth in part because Amazon is purposely increasing CapEx spendings here over the next few years. This suggests operating income for 2025 should come in at $76.59 billion.

From here, we estimate the operating cash flow for 2025 by first adjusting the operating income for taxes (~15% for Amazon) then adding depreciation, amortization, and stock-based compensation and adjusting for changes in working capital. Depreciation and amortization is estimated at 55 billion since it was 51 billion in 2024. We approximately SBC will stay consistent around 23.3 billion where it has been for both 2023 and 2024. For simplicity, we assume working capital will stay the same since it has fluctuated up and down year to year. Based on this, we estimate 2025 operating cash flow to be $143.40 billion.

Finally to get an estimate of FCF for 2025 by subtracting the capital expenditure spending. Amazon has previously given guidance that they intend to spend approximately $75 billion in CapEx in 2024 with more in 2025 so I estimate approximately $80 billion here. This suggests 2025 FCF should be around $63.40 billion. Notably, analyst estimates of Amazon 2025 FCF range from $65 billion to $86 billion so this estimate is on the lower end. For comparison, the current TTM FCF as of Q3 2024 is reported as $47.747 billion showing just how fast Amazon is still growing.

Using the DCF method of valuation and assuming:

2025 FCF of 63.40 billion

9% discount rate

A gradual slowing of growth as follows: 30% in 2026, 25% in 2027, 20% in 2028, 15% in 2029, 12% in 2030, and a long term growth rate of 4% thereafter.

suggests an intrinsic value of the stock at $219.50. At the time of this writing, this is right around where the stock is currently suggesting the stock is fairly valued.

Using an EPS valuation approach is also a bit tricky as earnings has been increasing rapidly over recent quarters. To get a bit more accuracy, we estimate Q4 2024 earnings as $1.47 (from analyst consensus) instead of the TTM figure. Combining this with Q1-Q3 2024 EPS of $0.98, $1.26, $1.43 respectively gives us an estimated EPS for 2024 of $5.14. Further assuming:

EPS growth rate of 25%

PE of 30

suggests an intrinsic value of the stock at $192.75. At the time of this writing, this shows the stock may be slightly overvalued but still within the range of what I consider fair market valuation.

Combining the 2 valuation methods, I would weigh more heavily on the DCF valuation and approximate the fair market value of AMZN at approximately $210.

Rationale for investment in AMZN

My rationale for investing in Amazon is a bit different from the valuation plays we’ve outlined in some of the previous investment thesis. As you can see from the valuation analysis, I believe Amazon at the start of 2025 is fairly priced. This is acceptable to me as outlined in my Criteria for Evaluation Stocks post and qualifies criteria (2) as a great company at a fair price. Amazon also gives me relatively safe exposure to AI which is an area I want additional exposure in for my portfolio thus helping with criteria (4).

There’s one additional reason I’m investing in Amazon and that’s the hidden potential. This may seem counterintuitive given the fair market valuation assessment but in fact it’s not. As I outlined in the overview of Amazon section, they have many small ventures that are currently not substantial but could in fact become something big. Amazon more than almost any other company has shown they can successfully execute on these ventures. Some examples of successful executions in the past include AWS, Prime Video, Amazon ads just to name a few.

What we assess in our valuation is just what we can see and predict. I believe given Amazon’s history, they may yet surprise us in the next few years with something we currently can not completely foresee. And if not, it’s still an amazingly well executed company at a fair price.

Finally, I wish to highlight some risks:

Competition is perhaps the greatest risk Amazon faces. Unlike a company like Alphabet which has a near monopoly on search, Amazon faces heavy competition in all their segments. From PDD’s price cutting competition to Microsoft and Alphabet’s cloud computing platforms, Amazon has to compete in all these segments. While this is a big risk, I believe Amazon has shown its ability to thrive in this environment. Furthermore, I think the company has been taking steps to create a stronger moat with Prime although I don’t think it will ever approach the levels of a free search engine like Google Search.

Loss of focus. Amazon has gradually been adding more and more ventures to their portfolio. Many ventures synergistically make sense but some recent ventures such as Satellite internet with Project Kuiper makes less sense to me. For the moment, I’m giving the benefit of a doubt but plan to keep an eye on future ventures. GE is a case study in over-diversification which is definitely not what we want here.

Economic downturn. Retail and commerce are more heavily impacted by a bad economy. I plan to mitigate this risk in the 2025 Swan Select Portfolio by incorporating other more defensive stocks.

In summary, I believe Amazon is a great company at a fair price if purchased around $210 per share with hidden potential upside and is one of the stocks in my 2025 Swan Select Portfolio.

If you enjoyed the content, consider subscribing below. I also encourage you to take a look at my website BlackSwan Investor for other investing writeups.

Disclaimer: Any information contained here is not intended as, and shall not be understood or construed as, financial advice. I am not a financial advisor and this is only a documentation of my personal investment journey and decisions. You should always do your own research before making any final decision on investments.

Good analysis. I don’t Like though that they haven’t started paying Dividend yet though the total Return of AMZN is awesome. Just like to get some bits of cash while waiting. 🤷🏼♂️😅

As a beginner, you can start investing with a surprisingly small amount of money. Thanks to zero-fee brokerages and fractional shares, you can begin with as little as $11. Here are some key points to consider:

Start Small: Even modest sums can grow over time. For example, you can invest in the stock market with just a few dollars through platforms that offer fractional shares1.

Budget and Prioritize: Before investing, ensure you have a budget in place, pay off high-interest debt, and have an emergency fund

Choose the Right Account: Depending on your goals, you might start with a brokerage account, a retirement account, or even a robo-advisor

Investing doesn't have to be daunting. Starting small and gradually increasing your investments as you become more comfortable can be a great strategy. What are your investment goals?